Pay $1,000 now, or $100/mo for a year?

How Buy Now Pay Later companies are shaking up the market

Hi, it’s Sri! This is a weekly newsletter that’s part public diary and mostly essays on tech, policy, and finance. To receive this newsletter in your inbox each week, subscribe here. You can also find me on Twitter.

All opinions and thoughts are my own and do not reflect the views of any organizations I’m affiliated with. My writing should not be misconstrued as financial advice.

What I’m thinking about this week:

What even is Buy Now Pay Later (BNPL)? How did it start? Where is it going?

Installment loans are the new credit

Imagine this-- you recently moved and desperately need a new couch. After browsing the likes of Ikea and Wayfair, you decide on one. It’s a black three-seater that costs you ~$1,120.

Or instead, with Affirm, you can pay as little as $101 per month for a year (which totals upto $1213).

What do you choose?

Customers are increasingly turning to Buy Now Pay Later (BNPL) solutions to break up a large online purchase into more manageable payments. Some BNPL solutions include interest, others don’t. Some affect your credit, others don’t. Customers only pay late fees if they are late on their payments.

While the concept isn’t new, BNPL companies are leveraging the growth in ecommerce and the decline in credit cards to sell installment loans to a new set of customers-- GenZ and Millennials. It’s estimated that 1 in 3 Americans have used BNPL to make a purchase, and BNPL accounted for over $24bn in spending in 2020 in the US alone.

The three biggest BNPL players today are:

Klarna: Founded in 2005 in Sweden, Klarna boasts 15m customers and 250K retail partners across 17 countries. More than 1m US customers join Klarna each month. The company raised an additional $1bn in March and is currently valued at $31bn.

Affirm: Max Levchin, who previously co-founded PayPal, started Affirm in 2012. Affirm has over 5.6m customers and went public in January 2021. It currently has a market cap of $18.8bn.

Afterpay: Afterpay is based in Australia and went public in 2017. The total number of US customers exceeds 16m, and Afterpay has partnered with nearly 75,000 merchants. Afterpay is valued at over $25bn.

The thing is BNPL solutions aren’t new.

BNPL solutions are incredibly similar to layaway programs, the rent-to-own industry, and credit cards. Here’s how these early innovations set the stage for BNPL.

Layaway & Rent-to-Own

One of the advantages of being the neighborhood greengrocer is that you have a sense of creditworthiness among your customers and can extend lines of credit accordingly.

But the Great Depression spurred the creation of the layaway program in America. A layaway plan essentially allows a customer to select a product, which the store “lays away” in storage. The customer then makes small payments towards the total cost over a set period of time. Once they complete the full payment, the customer receives the product. If the customer is unable to make a payment, the store takes a service charge and then refunds the customer’s purchase.

Layaway programs were targeted to shoppers who may have struggled to pay for purchases in one lump sum. Some viewed layaway programs as a great budgeting tool since they helped customers avoid debt.

In the early Internet days, online layaway programs also became more popular. The online versions offered the same service, just online. Platforms like eLayaway had more than 100,000 customers in its heyday. However as credit cards became ubiquitous in the 1980s, layaway became less popular, and eventually vanished, with Walmart largely shuttering its layaway program in 2006.

Although, an interesting exception to the end of layaway is the related rent-to-own industry. Founded in 1986, Rent-a-Center offers customers rent-to-own purchasing options for high-ticket items like appliances, computers, smartphones, and furniture. Customers make rental payments and have the option to own the product after completing the payments. The merchandise is typically marked up, sometimes more than five times as much as compared to other retailers. Rent-a-Center is a public Fortune 1000 company and has nearly 3,000 stores.

Credit Cards

Credit cards can draw their roots back to Diners Club cards, a cardboard charge card that founder dreamed up in 1950 after forgetting his wallet while dining out. The Diners Club charged merchants a 7% transaction fee and allowed customers to pay all their dining expenses at the end of each month. It became the world’s first charge card.

A few years later, the big boys-- like American Express-- joined the competition, offering customers the opportunity to use cards primarily at dining, travel, and entertainment outlets. But these cards were still primarily charge cards-- customers couldn’t easily access credit. People either applied for a loan at a bank or for a line of credit at the store they’re shopping at.

Department stores to this day offer retail credit cards. Remember how a store associate frequently asks you to sign up for an in-store credit card to take advantage of a discount? Merchants hawked these retail credit cards to increase the number of purchases and promote customer loyalty, but these credit cards typically came with high interest.

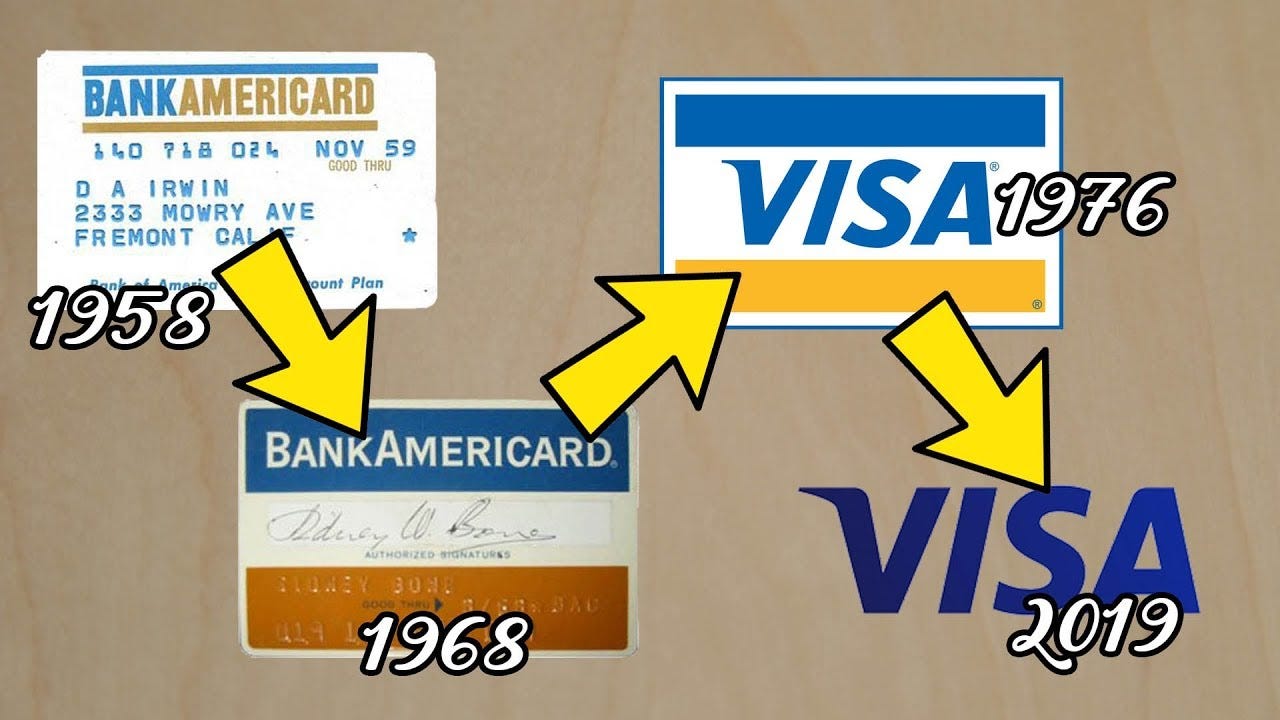

Recognizing these problems, Bank of America launched credit cards in 1958. Some of credit’s common features started with these “BankAmericards”. The cards came with pre-approved credit and could be used across a number of different merchants. Customers could pay back their loans in installments or at the end of the month, and interest would only start accruing after a one-month grace period.

Despite an initial stumble from a large number of defaults, Bank of America’s credit cards eventually became a hit. Credit card usage surged through the 1970s as a result of increased inflation because customers were incentivized to buy right away. Regulation also enabled banks domiciled in another state to offer credit to people from other states. To this day, Bank of America is a household name, and its business processing unit spun out to become another household name-- Visa.

These early innovations paved the path for BNPL.

Klarna initially found success in Europe as an early mover in 2005 because they noticed customers wanted to receive goods before paying. Customers wanted the option to easily return items if they didn’t like them. This sparked the BNPL movement, but the trend was further accelerated with the growth in ecommerce in the last decade. Just in the last year alone, ecommerce in the U.S. grew 44% and represented more than 21% of total retail sales for the year.

BNPL is also perfect for America’s post-recession economy. Though BNPL solutions function similar to credit cards, the key difference is that customers won’t rack any fees or interest as long as the amount is paid on time. As such, BNPL is a shinier alternative to credit cards for younger customers that came of age during the Great Recession and COVID-19 pandemic. They may not perceive BNPL as debt and instead as a convenient method to spread out the cost of their purchases.

BNPL solutions are also a hit with merchants-- it leads to increased conversion rates, order sizes, and frequency of purchases. Merchants can offload chargebacks and disputes to the BNPL providers. It also expands the market to include customers that might not have had the budget to pay upfront. In exchange, merchants pay BNPL providers a setup fee, a monthly payment, and a 4-8% transaction fee.

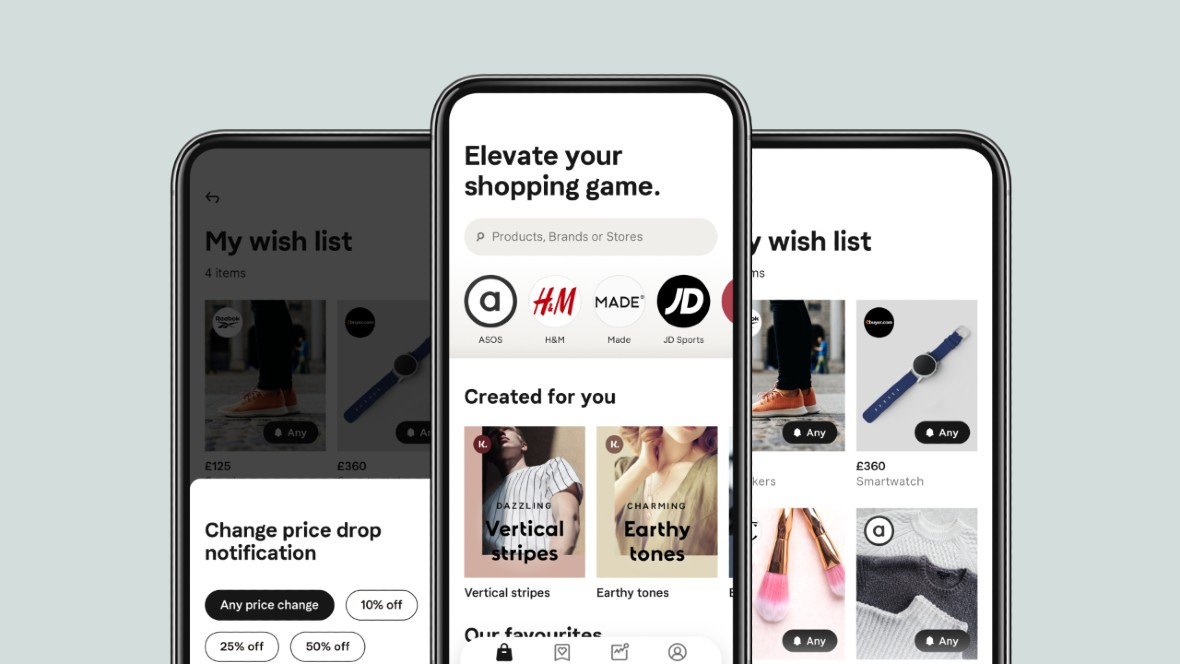

Today’s BNPL platforms are continuing to extend their reach beyond the checkout. BNPL is an opportunity to squeeze into other aspects of customers’ financial lives and the broader ecommerce ecosystem. For example, Klarna launched a consumer “shopping app” that enables users browse stores that offer Klarna. In February, Affirm announced plans for a U.S. debit card with direct access to pay-over-time functionality.

Credit or Not? Regulators are starting to pay more attention.

Credit cards share many similarities with layaway programs-- they’re both used to make a purchase that an individual can’t afford in the moment. They can incur late payment fees and default penalties, and they’re typically paid back in installments.

But there’s one big difference between the two. With a layaway program, a customer can only take the product home after making the full set of payments with a layaway program. Meanwhile, a customer can take a product home immediately after using a credit card. Credit cards give customers instant gratification, and BNPL platforms are just the same.

Like credit card companies, BNPL platforms may pose similar risks to consumers. Companies' high interest rates may lead customers to rack up more debt. Adding to that, BNPL debt isn’t typically checked by credit reference agencies and other lenders. As a result, the lack of strict affordability checks may cause customers to fall further into the debt trap. Affirm, for instance, can charge up to 30% in consumer interest.

In response to regulators’ concerns, some BNPL platforms are now starting to implement soft credit checks, limits on late payment fees, and freezes on customers’ accounts.

But regulation is the least of the BNPL incumbents’ concerns. This is only the beginning

Besides competing against each other to acquire as many merchants as possible, BNPL incumbents face a new set of competitors.

The big guys are starting to make moves. Amazon already offers a BNPL checkout option. Visa is developing a suite of installment solutions to allow clients to develop and pilot installment experience for their customers. PayPal has long offered credit and has since expanded to offer BNPL solutions as well. JP Morgan Chase waded into the waters as well, giving credit card customers the option to pay off purchases over a period of time with no interest.

Meanwhile, startups are itching to get in on the action as well. Some like Uplift are targeted towards big-ticket purchase items in a specific vertical, like flights and hotels. Others are applying BNPL to services like Wisetack for plumbing, Brick for home improvement, and Prima Health Credit for healthcare. A few are trying to be the “Affirm for Latin America'' or “Klarna for Africa”. Meanwhile, a handful like Tillit are applying BNPL to business products and services. With an increase in BNPL solutions, there’ll likely even be a need for customers to consolidate all of their payments across the BNPL providers.

But the biggest threat is likely still the status quo-- BNPL is still a nascent payment option in the ~$1trn credit business.

If you’re working in the space, please reach out-- would love to hear your thoughts! Reply back to this email, or find me on Twitter. Subscribe here to receive this newsletter in your inbox each week: